Many businesses are required to have their financial statements audited to assure the users that the amounts are objective and reliable. To make the topic of Accounting Principles even easier to understand, we created a collection of premium materials called AccountingCoach PRO. Our PRO users get lifetime access to our accounting principles cheat sheet, flashcards, quick test, and more. The profit and loss statement and statement of cash flows cover a particular time period, such as a quarter or a calendar year.

GAAP

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax’s permission. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. GAAP also seeks to make non-profit and governmental entities more accountable by requiring them to clearly and honestly report their finances. Newly incorporated companies are eligible to use SFRS for SE in the first two years of their incorporation. However, they must satisfy the eligibility requirements for the subsequent years to continue using SFRS for SE. Our partners cannot pay us to guarantee favorable reviews of their products or services.

Accounting Principles: What They Are and How GAAP and IFRS Work

Companies required to meet GAAP standards must do so in all financial reporting or risk facing significant consequences. The prudence concept also refers to a crucial principle used in accounting to ensure that income and assets are not overstated in financial statements. Alternatively known as the conservatism principle, it also makes sure that liabilities are not understated and provisions are made for income and losses.

Related Topics

Due to the comprehensive nature of the material, we are offering the book in two volumes. Each chapter opens with a relatable real-life scenario for today’s college student. Thoughtfully designed examples are presented throughout each chapter, allowing students to build on emerging accounting knowledge. Concepts are further reinforced through applicable connections to more detailed business processes. Students are immersed in the “why” as well as the “how” aspects of accounting in order to reinforce concepts and promote comprehension over rote memorization. OpenStax updates these textbooks on a regular basis, so there is no worry about using an outdated textbook for your classes.

Features of Accounting Principles

- GAAP is a collection of accounting principles and standards that public companies must follow to make sure their financial reporting is consistent.

- By adhering to this principle, you provide a comprehensive and transparent picture of your company’s monetary health to stakeholders.

- In other words, the company will be able to continue operating long enough to meet its obligations and commitments.

- CAs, experts and businesses can get GST ready with Clear GST software & certification course.

Other for-profit entities may also use the guidelines on a voluntary basis. Meanwhile, IFRS standards are principles-based, offering more latitude and subjectivity when interpreting guidelines. Notably, IFRS standards do apply to some business entities operating in the United States. Foreign-based companies registered with the SEC use IFRS reporting guidelines in their U.S. disclosure filings. Some U.S. small and mid-size enterprises (SMEs) voluntarily use IFRS accounting procedures, which are neither expressly permitted nor prohibited under applicable U.S. laws.

The emphasis on going outside the book and “surf the net” is practical and needed in today’s world. The authors also include “ethical perspectives” throughout each chapter highlighting the importance of integrity and honesty and asks the reader to think about what they would do. There are a number of times in which accounting profession career opportunities, salaries, etc. are mentioned incrementally throughout the text. It is rather interesting to remind students of these facts during the course of their studies. The text also highlights the importance of certification, as well as the requirements. Accounting is a discipline which requires compliance with regulations and principles as established by many agencies, governments, and conventionality.

There didn’t seem to be any display features that would distract the normal reader. These are not acceptable for the reading impaired, and it was necessary to retype them when using them for assignments. It would also be great to have page numbers included for students using the online version of the book.

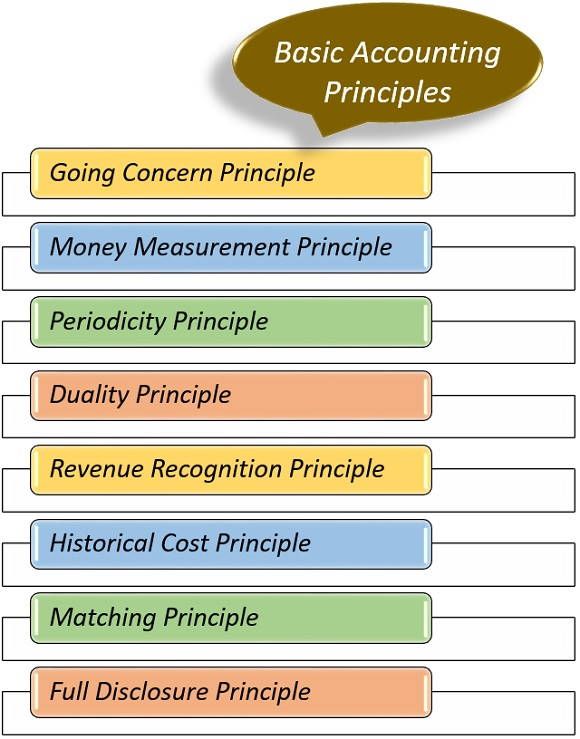

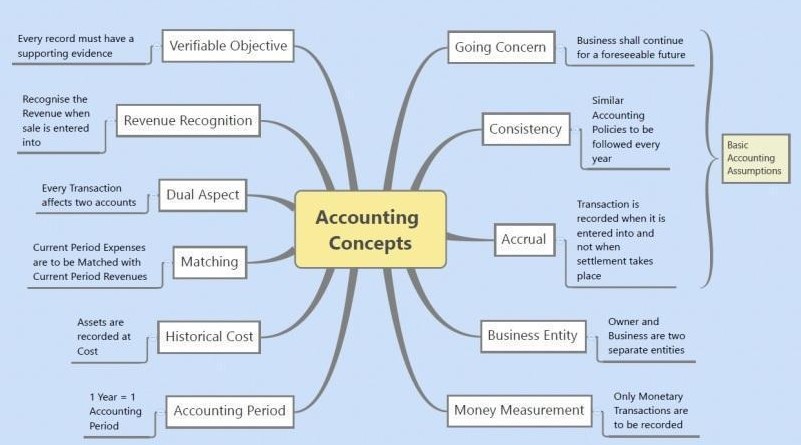

Accounting principles are the rules and guidelines that companies and other bodies must follow when reporting financial data. These rules make it easier to examine financial data by standardizing the terms and methods that accountants must use. The consistency principle encourages uniformity in accounting methods from one period to the next. It promotes comparability of financial statements over time, allowing stakeholders to analyse trends and make informed decisions. There are a number of accounting principles that accountants and investors follow to implement appropriate financial processes and make informed decisions. I do, however, feel that chapter 5 “Accounting Theory” as a single chapter may not be the most effective for students’ learning purpose.

GAAP allows for offsetting in certain specific circumstances, such as when assets and liabilities represent the same transaction or when a legally binding entitlement exists to offset the acknowledged sums. If the company arbitrarily switches to a different method, such as LIFO (Last-In, First-Out), in the next fiscal year, it would disrupt comparability. Such a change could lead to a sudden and artificial change in the cost of goods sold, gross margin, and net income, making it challenging to gauge true performance trends over time. Consider a company that adopts the FIFO method for inventory accounting. The cost of the earliest inventory items purchased determines the cost of goods sold in the FIFO inventory valuation method, presuming that the first items purchased are the first to sell. Except for certain marketable investment securities, typically an asset’s recorded cost will not be changed due to inflation or market fluctuations.

Consistency allows us to compare the financial statements of different periods of the company’s existence. This makes it easy for anyone to analyze the company’s performance and financial position. By adhering to these principles, businesses can ensure consistency, accuracy, and transparency in their financial statements.

My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Historical Cost Principle – requires companies to record the purchase of goods, services, or capital assets at the price they paid 5 principles of accounting for them. Assets are then remain on the balance sheet at their historical without being adjusted for fluctuations in market value. This textbook uses of T-accounts and diagrams to make the concepts become clearer for students. Principles of Accounting Volume 1 could be presented much more concisely, more simply; and with better clarity.